- May 13, 2023

- 1,538

- 113

1. Investopedia, the Onion of finance...

2. My numbers are correct, despite what your screenshot shows. I'd be happy to show you how to run the calculations on an HP12C calculator, if you're so inclined. The only way I can see your numbers being close is if you assume you started with $20,000 and then made an additional $20,000 per year for 8 years.

3. Using a Roth IRA for college is okay if you have no financial aid need, but any withdrawal is considered income on your financial aid application. So, you would lose aid eligibility by withdrawing money in any subsequent year.

4. You cannot contribute $20,000 annually to a Roth IRA.

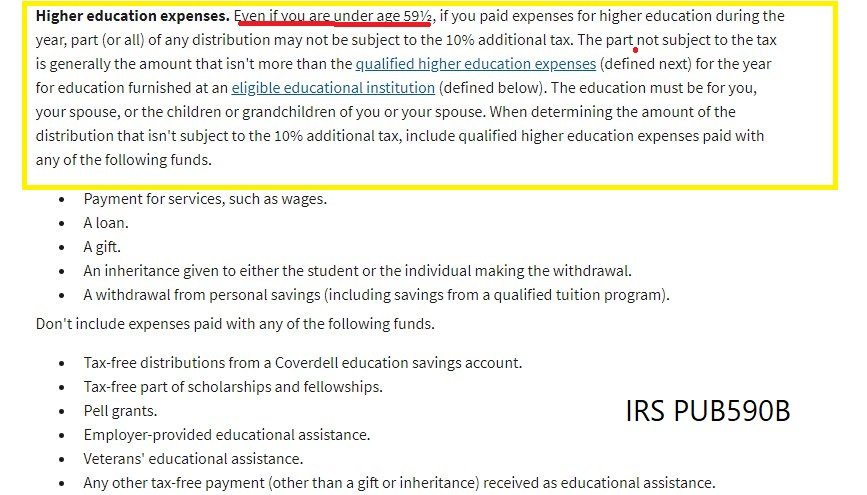

you have to be 59.5 to make a qualified withdrawal from a Roth or you pay a 10% penalty.

If you'd like to have a further discussion about finances and aid, feel free to PM me. Much of what you said is incorrect, so I'd love to correct it for you, but since this isn't technically a discussion about softball, I'll refrain...Sigh. I tried to leave you time to correct this. But, since we are trying to leave people with accurate financial advice...

1. Per IRS Pub 590B, there is no penalty for using a Roth for higher ed

View attachment 28167

2. One would be spending the first $20k right away this summer, so yes of course, 'assume you started with $20,000'.

3. Since you said you are over the income limit, you wouldn't qualify for financial aid.

4. ' You cannot contribute $20,000 annually to a Roth IRA'. This is correct., my post no. 3 reads 'Invest $20k (partly in a Roth) for 8 years'

Had a feeling you would take it that way. I'm not even saying that you are giving bad advice. Obviously you have a much different interpretation of those compliance regs than most in the business do and I would say that most of the larger Broker/Dealers would not allow it. Look, I enjoy talking about all of those other topics (besides softball) for sure. I also enjoy talking finance but will not (and can not) do so in the manner which you are on this public forum. I'm sure you feel that offering college financial aid workshops (or whatever you called them) to anyone on DFP who is interested is fine, or mentioning repeatedly that you're "in the biz" is okay. Soliciting bat, gloves and equipment sales on here is understandable. I don't think many would like a fellow DFP member trying to use the forum to sell them an extended warranty on their car or something similar. Solicitation (in our industry) is a fine line, if you feel you're in compliance then good for you. I appreciate your posts about softball, your DD's journeys as well as the jokes, music, cars and other stuff (usually) kept tucked away in the Off-Topic thread on here.Did I try to solicit securities business? Did I give any specific recommendations? Did I advertise for my business?

Did I mention any investments?

If you don't like me giving out correct information, go to a different thread. Yes, this is a softball forum, but I'm sure I can find plenty of cases where you posted about lawn mowers or beer. In fact, I seem to remember you professing your love for All The World's A Stage just a few days ago. Show me how that relates to softball.

All of my OBAs have been run through compliance and are fully disclosed.Obviously you have a much different interpretation of those compliance regs than most in the business do and I would say that most of the larger Broker/Dealers would not allow it.

On this, we are in complete agreement. Money means nothing compared to the joy softball has brought to my daughters, and therefore, me.Back to the OP - yes RAD, prices for all those travel related things are up but as you get closer to the end of your DD's playing career the memories and experiences seem to take on greater significance.

Was scrolling to the end to say this. The amount of fun, life experiences and family memories that we have made have made it worth it to us.On this, we are in complete agreement. Money means nothing compared to the joy softball has brought to my daughters, and therefore, me.

Can appreciate the folks here who want to talk about financial strategy!

What I notice more so in recent years is not only the lack of planning,

But the lack of awareness about how much college is going to cost.

Even with all the information that is available online, about assistance and financial calculators.

It is bizarre the amount of families, who even at the point their kids are juniors in high school, have not even begun to seriously look at college costs.

Then they are startled.

Perhaps it has become normal for a chunk of the population to live day by day by shoestrings.dont know...

Debt is a weird solution!